Over the last decade, middleware vendors’ product and growth strategies were fundamentally changed by JEE and SOA. Transaction/Database/Integration middleware vendors, both closed-source and open-source, standardized on JEE application servers or Java frameworks (AKA light-weight Java containers) as product foundation. This helped app-server agnostic vendors with new go-to-market opportunities and gave customers deployment flexibility. Vendors also embraced SOA principles of modular/self-contained services for product componentization, and standards-based implementation for product/vendor interoperability and extensibility.

According to Google Trends, interest in SOA began before 2004. A lot has changed since then. Different acquisition strategies have consolidated the MW vendor landscape (i.e. IONA, BEA, SUN, Cape Clear, FuseSource, JBoss, webMethods). The consolidation accelerated by new market trends such as Application Platform-as-a-Service (i.e. SpringSource, Heroku, Makara) and Integration Platform-as-a-Service (i.e. Cast Iron, Boomi). On the opposite side, some vendors changed product strategy of App+DB+Integration MW to refocus on their core strength (i.e. Progress Software sells off Orbix and Artix to Micro Focus)… Cloud, Big Data, and analytics continue to impact vendors product strategies and service offerings.

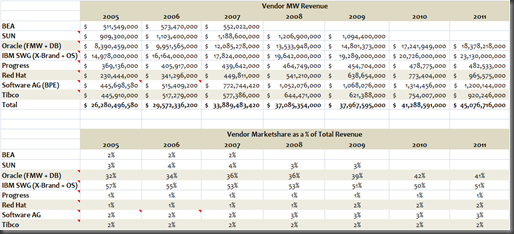

In this post, I am going to take a brief look at key MW vendors performance and marketshare based on revenues as reported in their annual reports. Different vendors have established different periods of their fiscal year. For example, IBM’s FY 2011 starts form Jan 1, 2011 to Dec 31, 2011. In Oracle’s case, FY 2012 starts from June 1, 2011 – May 31, 2012. So, in the following charts, when I list IBM and Oracle revenues for 2011, I am using numbers from IBM’s 2011 annual report and Oracle’s 2012 annual report. I will update this post with FY2012 / 2013 numbers once annual reports are available.

Vendors Overview

I decided to look at historical numbers for BEA, SUN, Oracle, IBM, Progress, Red Hat, Software AG, and Tibco. I selected these vendors, because they were/are well established in the enterprise middleware software space and recognized as leaders in the market.

As stated above, I am using middleware revenues reported by vendors in their annual reports. In some cases, these numbers include vendors’ revenues on non-JEE transaction middleware (i.e. Oracle Tuxedo, IBM CICS) and / or license or subscription revenues from OS (i.e. IBM zOS, Red Hat Enterprise Linux). Oracle numbers do not include revenues from Oracle Applications. They also don’t include vendor’s MW consulting or education services revenues.

Here are the vendors and their reported middleware revenues from 2004 – 2011:

In the total row, I have added up annual revenues by all vendors. I am using this number as a basis to approximate vendor’s marketshare. There are a couple of observations to make:

- Since 2005, Red Hat, Software AG, and Oracle have grown middleware revenues by 319%, 169%, and 119% respectively. During the same period, Tibco increased revenue by 106%, and IBM by 54%. Progress takes the last place with 31%.

- In the case of Red Hat, they have done a fantastic job of maintaining subscription renewals and signing new contracts. It is important to consider they are a new and different kind of software company, and also they don’t break down the revenues by product areas (i.e. RHEL vs. JBoss) . However, looking at their numbers prior to 2006 when they acquired JBoss, I am guessing Red Hat’s MW subscription revenue to be less than 20% of Red Hat’s revenue.

- Based on revenues above, it is reasonable to assume that IBM and Oracle have a combined MW marketshare of ~ 92%. Since 2005, Oracle’s marketshare has been incrementally increasing while IBM’s decreasing:

Oracle

Oracle has come a long way. In 1990, Oracle's total revenue was a little over $916M. By 2002, Oracle had already expanded its software portfolio beyond database and database related middleware, with JEE transaction server and Apps. By then, its software revenues exceeded $7B.

Since 2005, Oracle’s software segment (MW+DB+Apps) has performed much better than its closet competitors with steady YoY positive, annual growth despite global financial troubles and dragging economic growth. Oracle’s vision and strategy of Fusion and its targeted acquisitions have worked very well.

Looking at Oracle’s current revenue mix, it still remains a software company at its core. Services, which include consulting, education, and on-demand hosting, contribute a smaller percentage to Oracle’s total revenue. With the acquisition of SUN, Oracle entered hardware business. This has enabled Oracle with better execution of its Engineered Systems and powers Oracle Cloud.

IBM

They key business segments in IBM are IBM Global Services (IGS) which includes Global Technology Services (GTS) and Global Business Services (GBS), Systems and Technology Group (STG), Software Group (SWG), and IBM Global Financing (IGF).

Looking at IBM’s revenue mix, IGS and SWG have been key to IBM’s revenue growth over the last 8 years. (Margins on SWG and IGS is about 85% and 30% respectively). More than 50% of IBM’s revenue comes from Services. SWG makes up > 20%, but increasing. N.B. In 2008, for the first time in IBM’s history, SWG exceeded STG in revenue.

Looking at IBM’s revenue by geography, the executive team has done a great job of shifting resources to emerging and developing countries now beyond BRIC. According to IBM’s 2011 annual report, more than 22% of IBM’s revenue is realized from growth markets.

Here is a breakdown of SWG revenue by product areas:

IBM SWG is made up of different key brands: WebSphere, Lotus, Tivoli, Information Management, and Rational.

In the chart above, X-Brand MW (Cross-Brand middleware) refers to revenue from all SWG brands. IBM also sell software for mainframe. Other-MW refers to mainframe software for zOS (i.e. IMS, CICS). OS refers to zOS operating systems and AIX. In 2009, IBM sold off its PLM business to Dassault. And, “Other” refers to SWG lab services. When comparing IBM’s MW revenue with other vendors, all revenues except for Other and PLM were included.

In SWG, X-Brand MW has been growing while other segments have been declining. IBM doesn’t break down revenue by specific products, but attributes growth to specific acquisitions as follows:

- iLog and the Smarter Commerce offerings (Sterling Commerce + Coremetrics + Unica) have been key to WebSphere’s growth.

- In Information Management, FileNet, Netezza, and Cognos have fueled growth in that segment.

- Telelogic continues to help the struggling Rational brand, and

- Micromuse & MRO have been driving growth for Tivoli.

IBM’s SWG growth strategy is centered on Cloud, Mobile apps, Analytics, and generally new product bundles.

In 2012, IBM expanded its WebSphere product offerings with Mobile App Dev & Runtime with Worklight…”IBM Mobile Foundation” includes Worklight, Cast Iron, and EndPoint Manager for Mobile dev, runtime, & management.

In the late 90’s, IBM decided to exit the application market and focus on middleware. The strategy was to recruit business solutions providers (i.e. SAP, Siebel, PeopleSoft) to build on top of IBM MW, and go-to-market as partners. Oracle took a different approach. Their view was that the application market is fragmented and customers require heavy investments in integrating products and business solutions from different vendors to deliver a complete solution (See Fusion Apps Strategy). Comparing Oracle’s MW revenue against IBM’s, Oracle’s strategy has worked out better.

Progress

Progress is a mid-size vendor with products & services segmented under Application Development Platform (PureEdge, Orbix), Enterprise Business Solutions (Sonic, Actional, Apama, Savvion) and Enterprise Data Solutions (DataDirect)…

N.B. I reviewed Progress in December of 2012. Since then, they have fundamentally changed company and product strategies by divesting from integration middleware and focusing on application development (OpenEdge).

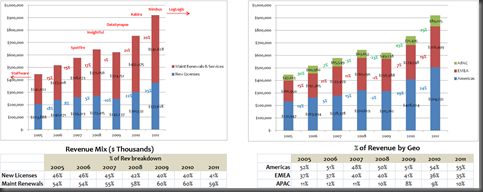

Progress makes most of its revenue from its Application Development Platform. Half of the revenue is realized through indirect channel and OEM.

In 2012, Progress decided to exit the integration middleware business and refocus on application development in Cloud (Application Platform-as-a-Service). They made a strategic announcement to divest 10 non-core products: Actional, Artix, DataXtend, FuseSource, ObjectStore, Orbacus, Orbix, Savvion, Shadow and Sonic.

Progress sold FuseSource to Red Hat, and Orbix, Artix, and Orbacus to Micro Focus. In addition, it sold off Sonic, Savvion, Actional, and DataXtend to Trilogy enterprises.

Red Hat

Red Hat product lines include infrastructure, middleware, virtualization, Cloud, and storage offerings. More than 85% of Red Hat’s revenue comes from maintenance and support subscription fees. Since 2002, Red Hat has had double-digit annual growth. Between 2005 – 2011, Red Hat’s revenue grew by 319%. In FY2012, Red Hat reached a major milestone of revenues > $1B.

Red Hat’s strategy is continued expansion of middleware offerings, and revenue growth by establishing new routes-to-markets. They are doing this through investment in OSS, acquisitions, and partnerships. (Red Hat has a large indirect channel of distributors/resellers, hosting providers, systems integrators, and ISVs.)

Red Hat has an active M&A strategy. With such acquisitions as JBoss, Makara, and FuseSource, it should be on the radar watch for both other open-source vendors such as Novell SUSE, MuleSoft, Talend, … as well as closed-source commercial vendors such as IBM, Oracle, VMware…

Software AG

Software AG is a large, well-established vendor with products & services segmented under Enterprise Transaction Systems (ETS), Business Process Excellence (BPE), and IDS Scheer Consulting (IDSC)…For more information, click here.

Software AG has an impressive revenue growth particularly due to services and consulting. The acquisition of webMethod gave incremental growth in new licenses and maintenance revenues. And, the acquisition of IDS Scheer expanded their services and consulting business from 28% of the total revenue in 2005 to almost 40% in 2011.

Product Strategy: App-Server agnostic, SOA, Analytics, Cloud, and Mobile

Growth Strategy: M&A, Geographic Expansion, Strategic Partnerships

Tibco

Tibco is an established integration middleware vendor with a long history in messaging. Currently, Tibco groups its products along business integration & automation, Event Processing, Analytics (Enterprise, Operational, Big Data), Cloud, and Social.

Despite tough competition from IBM, Oracle with broader mw and infrastructure software portfolio, and open-source integration middleware, Tibco has done a good job of growing revenue in both new licenses and maintenance renewals. In FY2012, Tibco’s revenue exceeded $1B.

Summary

The middleware software market is split between IBM+Oracle vs. the rest. Over the last 7 years, smaller vendors like Software AG and Tibco have been able to perform well despite tough competition. On the open-source software side, Red Hat has been doing very well breaking the $1B revenue mark. Cloud (aPaaS, iPaaS), Big Data, Analytics, and Social are impacting middleware vendors product, service offerings, and go-to-market strategies.