For the last couple of years, Oracle has shown a consistent strategy to Cloud Computing. It has made strategic acquisitions such as Virtual Iron to gain x86 virtualization management software, and has also made investments in new products such as Virtual Assembly Builder to facilitate configuration and governance of virtual environments.

Oracle has made clear that it intends to be a provider of technology to both enterprise customers and service providers. That it does not plan to be a public cloud provider/operator like AWS or Savvis. Instead, Oracle works with public cloud services as a distribution and delivery partner.

[Note: See AWS/Oracle announcement of support for Oracle middleware and apps on EC2 using Oracle VM images.]

---------

This post is a brief look at Oracle and its cloud strategy. First, I will review Oracle business, financial, and what it brings to Cloud Computing. Next, I will provide a 5-minute SWOT analysis of Oracle Cloud Strategy.

Oracle business

Oracle’s goal is to be the world’s most complete, open and integrated enterprise software and hardware company. In FY2010, it booked more than $26B in revenue. The company breaks down its revenue as follows:

- Software

- New software sales

- Software license renewals & support contract

- Hardware

- Hardware sales

- Hardware support & maintenance contract

- Services

- Consulting

- Education

- On Demand

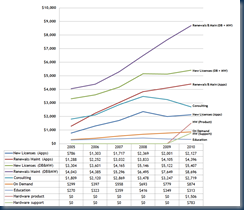

Here is their revenue trend for the last 5 years:

- Oracle made over 32% of its 2010 total revenue ($26,821 million) from database & middleware renewal, and about 16% from Fusion apps renewal. This is due to the fact that almost 90% of Oracle customers renew contracts. [Renewal has a margin of 85%, and is the key factor to Oracle’s overall profitability.]

- Oracle’s On Demand, which is where it offers hosted Fusion application, has also contributed to about 3% of total revenue. This segment has shown steady growth. In fact, since 2005, it has grown almost 3 times. [This is a key area to future growth for Oracle especially considering all the investments they have been making to standardize Fusion apps on Fusion middleware and continue to “SaaSify” the applications.]

Oracle Cloud Business Strategy

As stated earlier, Oracle intends to be primarily a Cloud technology provider/enabler as opposed to a service operator. This was further evidenced as it halted the rollout plans for Project Caroline after the Sun acquisition.

For enterprise customers, Oracle is addressing the needs for private cloud by providing integrated machines such as Exadata and Exalogic. These machines help customers consolidate workloads and scale up/down as demand grows. Oracle also continues with new products and enhancement of its middleware and enterprise management solution to enable customers build private clouds on their own hardware.

I think Oracle will be forced to change their cloud strategy for the following reasons:

- According to analysts, about 10% of IT budget is spent on external cloud services and that percentage will keep growing (see Gartner’s survey). Oracle needs to pay attention to this shift in enterprise IT spending, if it plans to increase marketshare and revenue. Large customers struggle with supporting workloads in the cloud, so they look for a vendor to not only help them move workloads to the Cloud, but also provide support and management. So, they look for hosted managed private clouds. Oracle could address this need by leveraging Sun assets such as Caroline to offer such services. This would position it well for future growth.

- It is common knowledge that Oracle wants to reach $100B in revenue in the next 10 years. Cloud Computing, including integrated systems, is a key growth strategy for Oracle. Oracle needs to diversify to reach that level of revenue in the next decade. It can’t rely on acquisitions to make that happen. Let’s assume Oracle acquires CA. That would only boost Oracle’s revenue by $4B.

Sidebar: Let’s play the following scenario. Let’s assume that on average with every Exalogic Oracle charges $1M for hardware and $3M for software. Furthermore, let’s assume a %20 maintenance revenue per box / year. If Oracle sold 1000 units every year for the next 3 years, they would book a total of $12B in combined new hardware and software + $4B in maintenance. Everything else constant, by 2014, Oracle’s revenue would grow by $16B to $42B. Can they do that?

Oracle Cloud Solution

The following diagram describes Oracle’s cloud solution model:

Oracle models its solutions based on different Cloud service offering. The diagram is pretty self-explanatory. At the IaaS level, Oracle Sun hardware, and virtualization technologies (Virtual Iron + Sun). Oracle offers other capabilities that are not listed in this diagram such as Virtual Desktop Infrastructure (VDI) and Oracle VM Virtual Box.

In the PaaS layer, Oracle uses a combination of virtualization to isolate workloads and management deployment + grid technologies to enable dynamic resources and scaling for applications.

At the top layer, Oracle and non-Oracle apps can be deployed on this platform. Oracle Fusion apps are optimized for Oracle Fusion middleware.

Finally, on the right hand side, there is the management layer…The slide is a cut and paste of Richard Sarwal’s presentation at Oracle OpenWorld. In that presentation, Richard also mentioned that there other capabilities and solution that Oracle will be offering in the next year (i.e. self-service portal, metering & charge-back, etc)

Oracle Cloud SWOT

In terms of integrated systems, Oracle will face competition primarily from IBM CloudBurst and Acadia. On the middleware side, IBM offers a similar set of offerings based on WebSphere and Tivoli (i.e. WebSphere CloudBurst, WebSphere Virtual Enterprise, Tivoli Cloud Management stack). Oracle will face competition from VMware vFabric. IBM has embraced VMware as a virtualization partner (on x86)whereas Oracle decided to acquire its own virtualization. That has been a source of friction between the two vendors.

In terms of deployment and support, IBM offers more choices than Oracle:

- IBM & Oracle both offer enterprise-owned cloud

- IBM offers managed private cloud services (using customers assets), but Oracle does not. A customer would have to get a managed services contract from an Oracle partner like Wipro.

- IBM offers IBM-hosted private cloud, but Oracle does not. A customer would have to sign a contract with an Oracle Cloud provider like Savvis that offers both hosting and support services.

- IBM offers a public cloud where multiple tenants share the same infrastructure. This is useful for certain workloads (i.e. email, public website) and cloud scenarios (development and testing). Oracle doesn’t offer that. A customer would have to find a Pay-As-You-Go provider like AWS.

So, here is a quick SWOT of Oracle Cloud:

Let me know what you think?

Do you think Oracle can reach $100B in the next 10 years through an acquisition only strategy? What other challenges do you see in Oracle’s cloud strategy, and selling its middleware machine into the enterprise?

1 comment:

Great post about the Oracle! I have been reading a lot about the IBM Cloudburst online that's how I came across your post. Thank you for sharing this with us!

Post a Comment